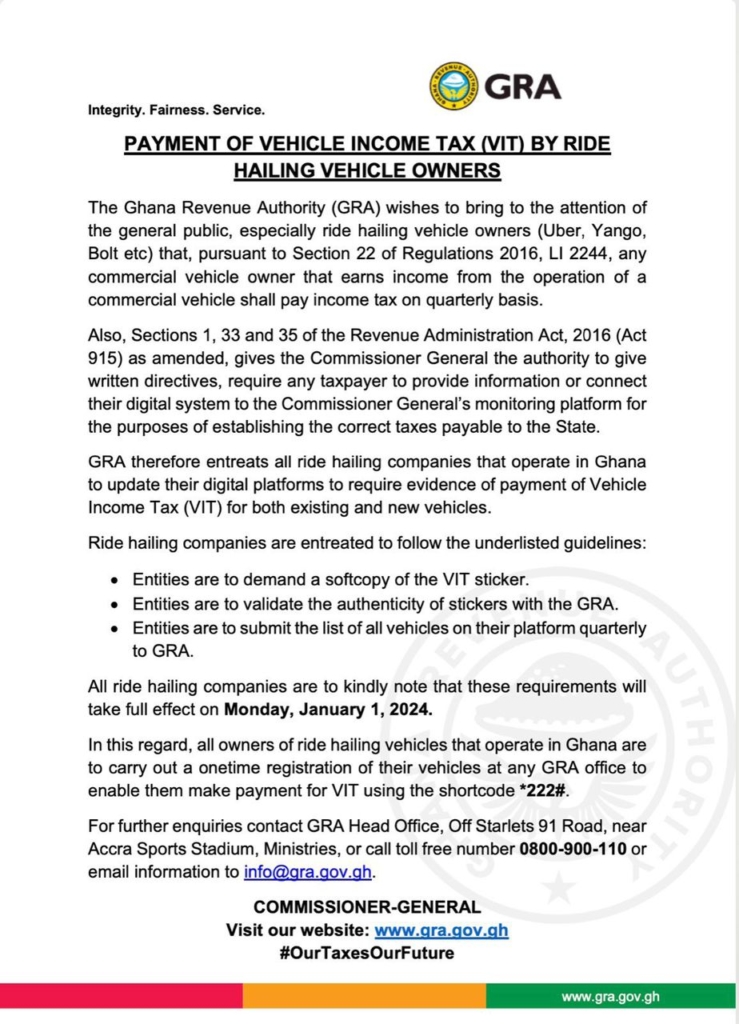

The Ghana Revenue Authority (GRA) has issued a notification to ride-hailing vehicle owners regarding the implementation of a new tax policy called the Value Income Tax (VIT), effective from January 1 2024.

As per Section 22 of Regulations 2016, LI 2244, the GRA specified that “any commercial vehicle owner that earns income from the operation of a commercial vehicle shall pay income tax quarterly.”

The Authority has advised ride-hailing companies such as Uber, Yango, and Bolt operating in Ghana to update their digital platforms to integrate the new tax requirements.

Guidelines for compliance include obtaining a softcopy of the VIT sticker, validating the sticker’s authenticity with the GRA, and submitting a quarterly list of all vehicles on their platforms to the GRA.

The GRA has emphasized that these requirements will be enforced on January 1, 2024.