Unlike paper currency or many other types of assets, gold has maintained its value throughout the ages.

First used by cultures in modern-day Eastern Europe in 4,000 BC to make decorative objects, the metal today represents a global business with operations on every continent, except Antarctica.

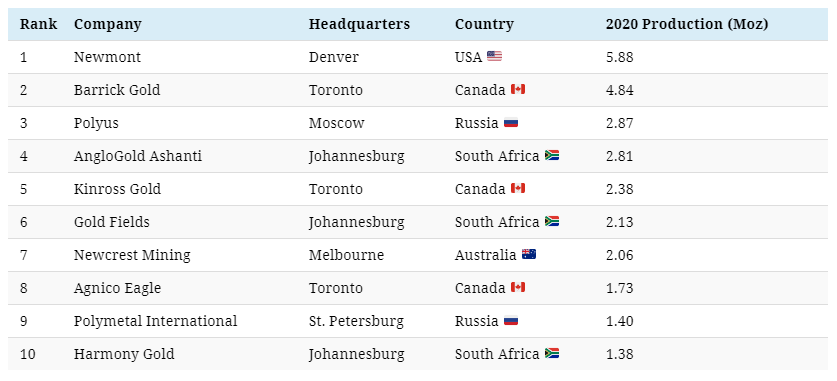

The industry is dominated by a select group of majors.

Together, the world’s top 10 gold miners produced 27.48 million ounces (Moz) in 2020, worth approximately $48 billion, according to data from Mining Intelligence.

North America leading

At a country level, China is the largest producer in the world accounting for around 11% of total global production.

However, no Chinese company appears among the top miners.

At the top of the gold mining companies list, Colorado-based Newmont has ownership of mines in Nevada, Colorado, Ontario, Quebec, Mexico, the Dominican Republic, Australia, Ghana, Argentina, Peru, and Suriname.

As the only American company on the list, Newmont produces 21% of the yellow metal poured by the top companies.

Canada, which is known for its mining industry, has three companies on the list; Barrick Gold, Kinross Gold, and Agnico Eagle, producing 32% combined.

Russia, which is expected to become the world’s top producer by 2029, has two companies ranked. Together, Polyus and Polymetal represent 15% of the top miners’ production.

The top 10 players account for ~22% of the total market share, which is anticipated to grow due to increased merger and acquisition activities.

Wealth and luxury

Over six and a half thousand years after its discovery, more than 90% of the gold mined annually is destined for jewelry, bullion, and coins.

- Jewelry: 36.83%,

- Investment: 46.64%,

- Central banks: 8.58%,

- Technology: 7.95%

The metal is also used in dentistry, as it is the best material for fillings and crowns since it is easy to insert, and is non-reactive with the human body.

Golden future

Global production fell by 1% in 2020, the first decline in a decade, according to the World Gold Council.

Some analysts argue the world has reached “peak gold” – which means that the maximum rate of extraction has passed and the production of the metal will continue to fall until, eventually, mining for it shall cease entirely.

Demand, however, shows no sign of slowing down as the golden metal remains firmly synonymous with security, stability, and longevity.