Government says persons believed to have caused financial losses to the State leading to the banking sector clean-up will be duly prosecuted.

Deputy Attorney General and Minister of Justice, Alfred Tuah-Yeboah maintains, bank owners such as Dr. Kwabena Duffour of uniBank and Kofi Amoabeng of UT Bank and others will be prosecuted in order to recover monies misspent.

This comes after an Accra High Court changed its position and accepted the GH¢90 million repayment terms for a restitution deal between state prosecutors and Ato Essien, the embattled founder of now-defunct Capital Bank.

The Bank of Ghana revoked the licenses of nine banks during the financial sector clean-up.

They included UT Bank, Capital Bank, Sovereign Bank, Beige Bank, Premium Bank, The Royal Bank, Heritage Bank, Construction Bank and uniBank.

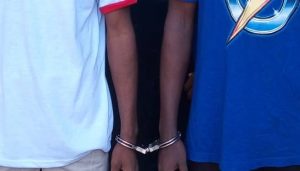

Some former officials of these banks are facing several charges over their purported culpability in leading to the collapse of the financial institutions.

Speaking in an exclusive interview with Citi News, Alfred Tuah-Yeboah confirmed that, government’s quest to retrieve the monies and prosecute all other suspects is on course.

“Some of them are in court now facing prosecution. UT Bank is in court now. For uniBank, there are some people in court now same as Beige Bank”, he emphasized.

“We are also looking at the Savings and Loans and Microfinance Companies. In fact, EOCO and other investigative bodies have done so much and extensive work on these institutions. So we are preparing the dockets. Our mission is to prosecute and possibly recover”, the deputy AG continued.

In a related development, the second and third accused persons in the Capital Bank case, Tetteh Nettey and Rev Fitzgerald Odonkor respectively have been acquitted and discharged by an Accra High Court.

The two were both charged alongside the founder of the defunct bank Ato Essien.

With that same case that the Court reconsidered its decision on the GHC 90 million deal between founder of capital bank Ato Essien and the State, Alfred Tuah-Yeboah argued that the funds were state funds as the defunct capital bank has been taken over by the state and state funds expended to pay the monies of depositors.

Earlier, Justice Eric Kyei Baffour, a Justice of Appeal, sitting as an additional High Court Judge, rejected the agreement, indicating that the amount agreed to be paid was not good enough, and adjourned the case to December 13 for the parties to address the court on the legal basis of the terms of the agreement.