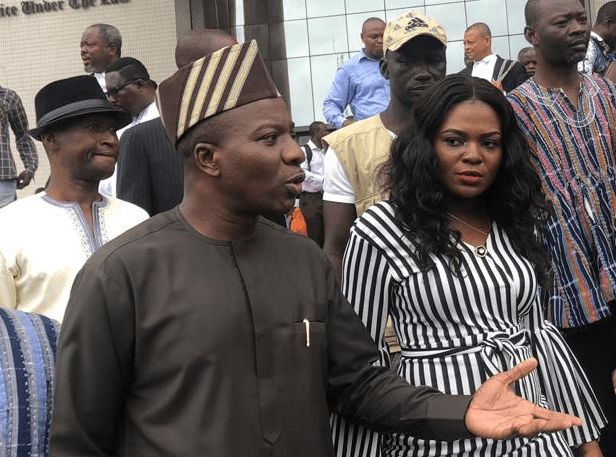

The Member of Parliament for Bawku Central, Mahama Ayariga, has petitioned the Bank of Ghana Governor to investigate the Board Chairman and Chief Executive Officer of the Ghana Amalgamated Trust (GAT) over their alleged plan to offload the trust’s shares to third parties.

Mr. Ayariga in his petition argued that Albert Essien and Eric Otoo were coordinating with the Ministry of Finance and the Second Deputy Governor of BoG to implement the transaction.

“The Finance Minister through its agents at GAT and SEC is in the process of offloading GAT shares to its third party nominees without giving an opportunity to original Ghanaian shareholders to buy same. This questionable conduct must be investigated by BoG and halted immediately or BoG will be seen as complicit if it is ultimately proven to be fraudulent and this will expose the bank to grave liability.”

He said GAT, under the leadership of the two, had also engaged in various questionable transactions that had weakened the corporate governance capacity of some banks, thus rendering them vulnerable in the financial sector.

“GAT engaged the various banks at sometime in 2019 when the banks urgently needed capital injection to meet the new BoG recapitalization requirement.

“Though some of the banks were, prior to the closing of the transaction, described as a solvent, well-governed and well managed, these banks were forced by circumstances of having to meet the BoG’s minimum capital requirement within the stipulated time frame to accept the offer from GAT.”

Mr. Ayariga said the Minority will not hesitate to take legal action against the Securities Exchange Commission (SEC), GAT, and BoG if his claims are not investigated.

The GAT, which is made up of some private pension funds in the country was put in place to support five banks that were unable to meet the GHc400 million capital requirement but were solvent.

The five banks were: ADB, NIB, merged Omni/Bank Sahel Sahara, Universal Merchant Bank, and Prudential Bank.