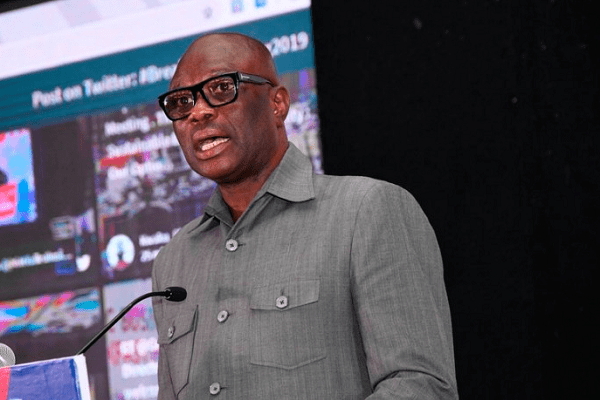

President of the Ghana Union of Traders Association (GUTA), Dr. Joseph Obeng has expressed disappointment with Parliament’s approval of the three revenue tax bills.

Dr. Obeng bemoaned the implications of the taxes approval and said it will affect the rate of tax compliance by businesses because it will be a discouraging act to honour.

He said Ghanaian businesses are particularly not competitive in the West African Sub-Region due to the high taxes that they have to pay.

“Businesses are not competitive in the subregion and that is why some of us have to go and buy goods from Togo, so additional taxes will really affect our trade. It is going to make us pay a multiplicity of taxes and that is why we called it an obnoxious tax system.”

Dr. Obeng further lamented the high commercial lending rate which he said is another big disincentive for businesses in the country.

“Commercial lending rate is at 40 percent, and how do you want businesses to pay this and still have money to pay all these taxes? We are very disappointed at how we are producing our democracy here because it is all about imposition, this approval is going to impede our growth.”

Parliament yesterday, March 31, passed the Income Tax Amendment Bill, Excise Duty Amendment Bill, and Growth and Sustainability Amendment Bill which collectively, are expected to generate approximately GH¢4 billion per year to supplement domestic revenue.

Dr. Obeng also tasked the government to look at other sectors to raise revenue other than overly burdening local businesses with taxes.

“We should curtail the leakages at the Free Zones and warehousing to help raise the needed revenue.”