The minority in parliament say they are happy Ghana has already lost half of the 2022 revenue the government projected to have accrued from the Electronic Transaction Levy (E-Levy).

This, according to the Minority Leader in Parliament, Haruna Iddrisu is attributed to the stiff opposition and constructive criticisms the group mounted against the approval of the E-Levy policy which resulted in the government reducing the proposed rate of 1.75 per cent to 1.50 per cent.

“This minority succeeded in reducing E-Levy from 1.75 per cent to 1.50 per cent . When he [Finance Minister] came [to Parliament], his intention was 1.75 per cent. There were many other activities that would have been captured by E-Levy, they’ve abandoned it. Thanks to the opposition and our constructive criticisms of the policy in order to be able to improve, including, remittances”, noted Haruna Iddrisu.

He added “Even more importantly, government has already lost half-year revenue of whatever it anticipated from E-Levy. That can only be attributed to the purpose and tenacity of the Minority Group in Parliament. You may be dissatisfied with us. We just took a legal step, with probably, we may not satisfy you but I don’t think that it’s all wrong”, he stated.

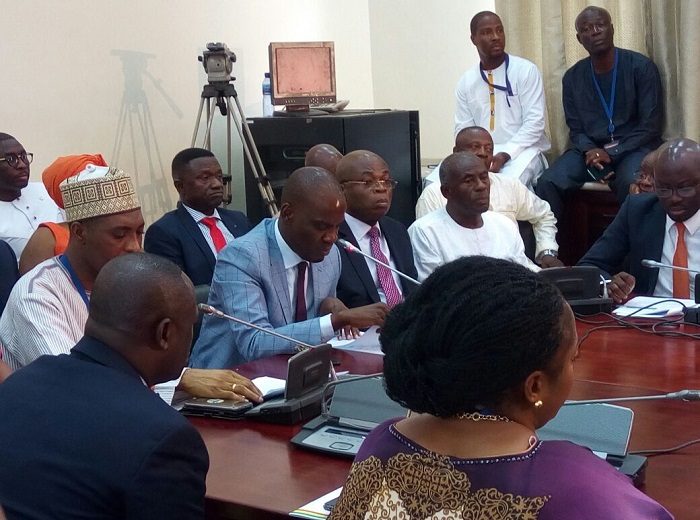

Mr. Iddrisu who is also the NDC MP for Tamale South was addressing members of the Parliamentary Press Corps (PPC) at a Leadership Encounter with the Press last Wednesday.

The encounter was to give an update about what the House has been able to achieve over the last six months and what it is expected to do in the coming months.

Commenting further, Mr Iddrisu said the minority group in Parliament will continue to ensure that Ghanaians are treated fairly by the government.

On Tuesday, March 29, 2022, the Parliament of Ghana approved the controversial 1.50 per cent tax on electronic payments, known as the E-Levy, after the opposition NDC MPs walked out in protest.

The NDC MPs had claimed not to be part or associated with what they termed ‘killer’ and ‘unwarranted’ tax on Ghanaians.

The Finance Minister, Ken Ofori-Atta had proposed the E-Levy in November 2021, with the aim of widening the tax net in order to mobilize more revenue to address Ghana’s financial woes.

However, his proposal hit a snag after the NDC MPs opposed the deal and demanded that the 1.75 per cent rate should be reduced to 1 per cent They therefore called for the proposed tax policy to be withdrawn and a new one introduced.

After back and forth arguments over the tax proposal, it was withdrawn and a new proposal introduced, this time proposing a rate of 1.50 per cent.

Even with the new proposed rate, the Minority Group wasn’t satisfied, compelling them to walk out during the consideration of the policy.

The E-Levy covers mobile money payments, bank transfers, merchant payments, and inward remittances.

The Government has projected to raise GHS6.9billion in revenue from the E-Levy in 2022.