Some officials of Payboy Company Limited, a payment company that was recently appointed by Menzgold Ghana Limited to negotiate a settlement with its unpaid customers have been arrested by the Economic and Organised Crime Office (EOCO).

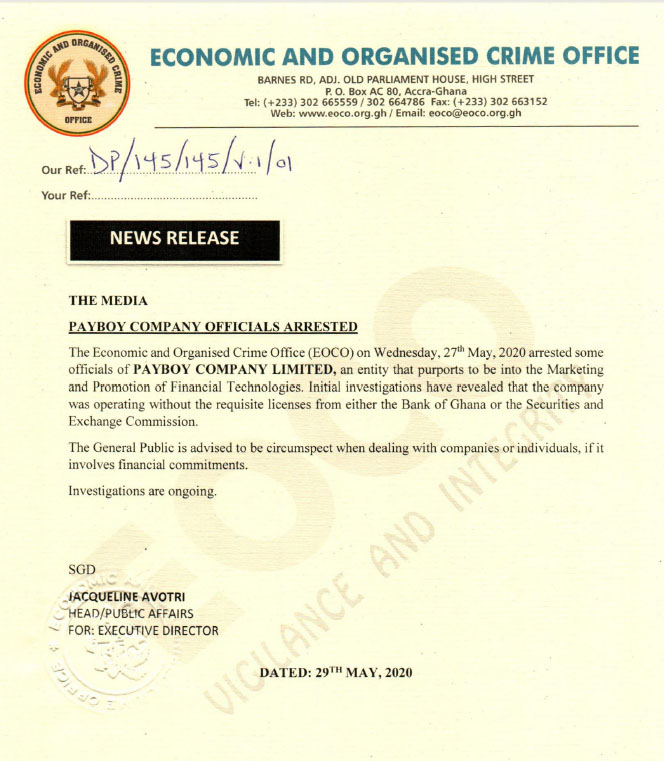

According to EOCO, Payboy is an entity that purports to be into the marketing and promotion of financial technologies.

But EOCO says its initial investigations have revealed that the company was operating without the requisite licenses from either the Bank of Ghana (BoG) or the Securities and Exchange Commission (SEC).

EOCO in a press statement signed and issued by its Head of Public Affairs, Jacqueline Avotri on Friday, May 29, 2020 advised the public to be circumspect when dealing with companies or individuals if it involves financial commitments.

The statement said EOCO arrested the officials of Payboy on Wednesday, May 27, 2020, and that, investigations are still ongoing.

It would be recalled that Menzgold, the troubled gold dealership company, which the BoG and SEC have stated that it had no license to have engaged in the nature of the business it was engaged in, recently announced the appointment of Payboy as a third-party entity to negotiate the settlement with its customers.

Many customers of Menzgold have had their investments locked up following the intervention by the BoG, SEC and the security agencies.

Menzgold in a recent statement announced the appointment of Payboy as the one to intervene, negotiate and facilitate the payment of the investment of its customers whose investments are still locked up.

In October 2018, the police received a complaint from about 16,000 people that Menzgold had convinced them to invest GH¢1,680,920,000 in a gold purchase scheme that yielded 10 percent monthly interest.

The complainants said their money was locked up and they could not find the Chief Executive of Menzgold, Nana Appiah Mensah (NAM1) and the other principal officers of the company.

Police investigations revealed that Menzgold and Brew Marketing Consult were incorporated as limited liability companies in 2013 and 2016 respectively, according to what prosecutors told the Accra Circuit Court in July 2019 when Nana Appiah Mensah was arrested and arraigned in court.

Menzgold, according to the police, obtained a licence from the Minerals Commission in August 2016 to purchase and export gold from small-scale miners and that in order to successfully engage in the business, Nana Appiah Mensah, the Chief Executive founded Brew Marketing Consult to be a gold buying agent.

According to the police, although Menzgold was licensed to purchase gold, it was not licensed by the Minerals Commission to trade in gold.

Notwithstanding the lack of such a licence, Menzgold went public after its incorporation and invited members of the public to deposit money for a fixed period with interest on the pretext of gold purchasing.

The complainants have since been chasing Menzgold to refund them their investments.

Source: Graphic.com.gh