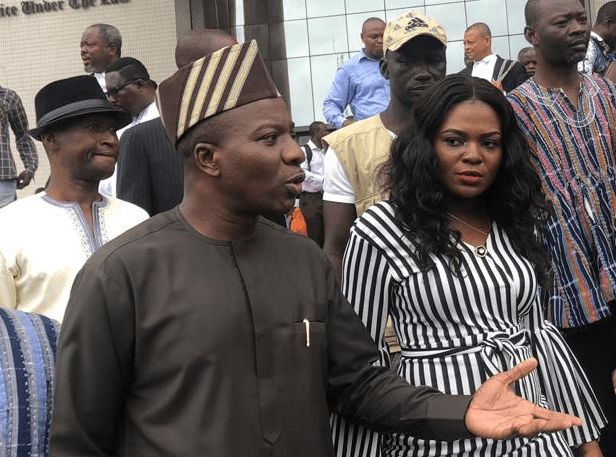

Member of Parliament (MP) for Bawku Central, Mahama Ayariga has once again petitioned the Bank of Ghana to investigate the alleged ‘negative activities’ of Board Chairman of the Ghana Amalgamated Trust (GAT), Albert Essien and its Managing Director, Eric Nana Otoo.

Mahama Ayariga has accused the two of planning to offload the trust’s shares to third parties.

According to the Bawku Central MP, Albert Essien and Eric Otoo were coordinating with the Ministry of Finance and the Second Deputy Governor of BoG to implement the transaction.

The lawmaker has thus called on the Central Bank governor to issue a cease and desist letter to the trust to enable a fair investigation.

“I acknowledge receipt of the letter dated January 6, 2022, from the Board Secretary on the above-mentioned subject. I have taken note of the fact that GAT has not applied to the Bank of Ghana (BoG) in their disingenuous quest to dispose of their shares in the bank to private persons.”

“Indeed, this omission to seek your approval, which you have graciously confirmed, is the main concern of this communication. I have contended that GAT is a financial holding company by any stretch of our interpretation of the definition of a financial holding company in section 43 (2)(a) and 44(1) of the Banks and Specialized Deposit-Taking Institutions Act, 2016 (Act 930). As you are aware, of Section 49 of the Banks and Specialized Deposit-Taking Institutions Act. 2016 (Act 930) is very clear that a person will require the prior written approval of BoG before transferring any shares which affect a significant shareholding in a specialized deposit-taking institution or a financial holding company.”

He noted that GAT was established as a Special Purpose Vehicle with only one objective of holding shares for the government in an arrangement to take shares in certain banks in exchange for funds to enable them to meet the BoG capital requirement for banks.

He further noted that any sale of GAT’s shares as a company amounts to a sale of GAT’S shares in the various banks because GAT has no other asset apart from these shares purportedly held for government.

“It is an undeniable fact that GAT is attempting to bypass strict regulatory oversight to sell GATS significant shareholdings in banks. Without BoG’s prior written approval GAT is indirectly selling off the various shares in the Banks.”

The Ghana Amalgamated Trust (GAT) was established by an Act of Parliament to help financially resource some local banks to enable them to meet the minimum capital requirement of commercial banks during the onset of the banking sector clean-up.