Direct participation by domestic retail investors on the equities market remains the most significant indicator of the level of confidence in the market, and concerted efforts are required to reverse the phenomenon locally.

This is according to a consultant to the Ghana Stock Exchange (GSE), David Ganesha Tetteh, who argues that despite the current rate showing signs of improving interest by individual investors, actual participation – which is less than 10 percent – remains woefully lower than the global average.

“The largest measure of investor confidence in any economy is how much the local people invest in equities; and given that we have a huge gap in the number of people who are exposed to capital market products, if we were to conduct a survey we would see a gap in investor confidence. We know that in our market, direct participation by local investors in the capital market is less than 10 percent. Most of it is through collective investment schemes, and to improve confidence we need to get more local people to invest in our capital markets,” he said.

He made this known while speaking on the topic ‘Enhancing Investors’ Confidence: Critical Vehicle to Driving Economic Growth’ during a plenary session at the Money Summit organized by the B&FT.

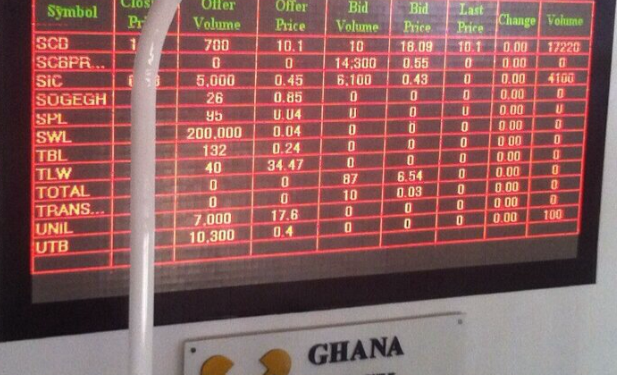

A breakdown of investor participation on the local bourse as of December 2021 shows that domestic investors accounted for 7 percent (GH¢72.2million) of the total value of trades in the year. This pales in comparison to the 20 percent and 68 percent by local and offshore institutional investors respectively.

The data from the GSE shows that while local retail investor participation maintained the 7 percent participation rate as of the end of February 2022, domestic institutional investors saw their activity drop to 11 percent. Consequently, foreign institutional investors accounted for 82 percent of the market share.

Information gap

According to the capital market veteran, inasmuch as information related to the capital market abounds, it appears a large section of the would-be investing public do not access the information.

“For companies who have raised money on our markets and their interactions with investors, there is a lot of information that is published about the capital market – the Exchange, collective investment schemes – but it seems it does not reach everybody.”

To remedy this situation, Mr. Tetteh said, the GSE, introduced its ‘Facts Behind the Figures’ sessions through which listed companies have real-time interactions with key stakeholders. Additionally, he stated, the Exchange is exploring other ways of adopting technology to reach more market participants on the buy-side – investors; and sell-side – companies.

“The more information individuals have about investments, the more investor confidence will grow,” he stated.

Mr. Tetteh also urged companies to set up investor information desks and brokerage firms to publish research reports to further inform the market, adding: “If we continue along this path, we will be able to increase investor confidence”.

Rest assured

Addressing concerns about investor-apathy following the recent financial sector reforms, Mr. Tetteh said the sector, led by its regulator – the Securities and Exchange Commission (SEC) – has sanitized the space and the growth in assets under management and returns is proof of gains made.

“There are people who have had their fingers burnt from the first episode, who are reluctant to invest and are keeping their money idle. The assurance is that the market has been sanitized. The regulator has put in so many changes to protect investors and lessons have been learnt. In the last four years, we have seen growth in funds under management as well as a rise in new and returning investors.

“The regulatory regime and frameworks are stronger now; the fund managers that remained are stronger now, as they have been recapitalised and they are in a much better position to manage the public’s funds without any problems. Investors should be confident that the market is back,” he added.

Some of the measures undertaken by the regulator including raising the minimum capital required for fund manager from GH¢100,000 to GH¢2million. Additionally, a Conduct of Business guideline that requires qualifications of directors has been introduced.

The real sector

For the aforementioned efforts to have sustainable impact, Mr. Tetteh added, there is a need to channel long-term capital into the real sector. He stated that the GSE, in partnership with other institutions, continues to make this possible.

“As it is now, most of the available pool of funds heads back to government; and clearly, that is not the way the economy will grow. The stock exchange has been at the forefront of advising policymakers, including working with the Pensions regulator to draft new regulations to floor for variable income securities and the SEC on the wider Capital Market Master Plan… The GSE has positioned itself to be an exit-point for private equity investment. And the more companies which can exit, the more people will be willing to invest in the private equity ecosystem.

“This is meant to drive long-term capital to the real sector; and as we continue to do so, we will achieve the investor confidence that we need to grow our economy,” he added.