The Ghana Stock Exchange’s Financial Stock Index (GSE-FSI) is on course for its first positive annual return since 2017, data from the Accra bourse indicates.

The GSE-FSI, a market capitalization-weighted index comprising stocks from the banking and insurance industries, returned -6.79 percent, -16.94 percent, and -11.73 percent in 2018, 2019, and 2020, respectively, on the back of the financial sector purge, which began in 2017 and the emergence of COVID-19.

However, with three weeks to the close of the year, the index appears to have rebounded win tandem with the general market, posting a year-to-date (YtD) return of 17.91 percent spurred on by the resilient performance, particularly of banks, over the last 18 months as they come out of their shells following the sector crisis.

The index has also recorded a one-year change of 28.52 percent and gained a modest 0.38 percent over the last four weeks and is currently hovering around 2,089.21 points.

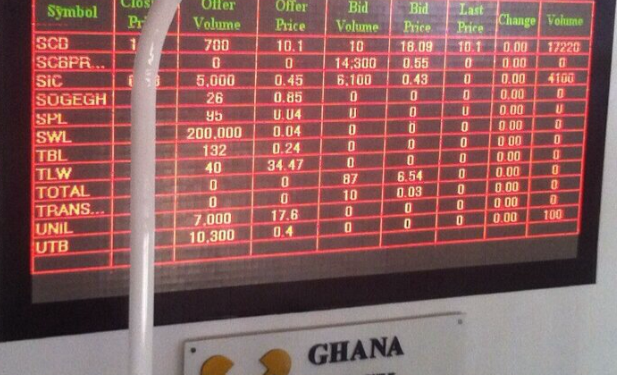

Leading the pack of the 13-stock Index for YtD appreciation is Societe General, 87.5 percent; Enterprise Group, 80.71 percent; Republic Bank, 46.34 percent; GCB Bank, 29.63 percent; and Standard Chartered, 24.77 percent.

At the other end of the spectrum, Access Bank has fared the worst, with a YtD dip of 28.25 percent and SIC Insurance at 12.5 percent. Of note, however, only three of the 13 listed stocks have a price-to-earnings (P/E) ratio in excess of 10, with half of them trading below five.

Commenting on the development, investment analyst at Nimed Capital, Joshua Adagbe observed that the oversight and corporate governance structures of the foreign-owned banks served them well during the sector clean-up exercise and the pandemic, adding that these factors are largely responsible for the performance of leaders.

“When we look at the best performers – Societe General, Republic Bank, Standard Chartered and Ecobank – we see a thread running through and that is a stabilizing parental control for most of the multi-national banks. They were not as affected by the exercise and have been able to return to regular business not long after. They have been able to maintain the same standards that they operate within other regions,” he explained.

“We have seen many of them, when you look at the trajectory, posting very positive results over the course of this year.”

Mr. Adagbe added that a focus on digitalization in streamlining their service offerings has increased the visibility and consequently, the appeal of some of the best-performing banks, adding that he expects the trend would not deviate significantly in the short-term.

“Some of them, we have seen, are merging all their products to make them easier to access, others have done quite well in their auto financing, and we continue to see measures to minimize non-performing loans and increase revenue mobilization.”