The Ghana Stock Exchange ended last year as Africa’s 2nd best performing stock market , in bot dollar and cedi terms.

In dollar term, the exchange recorded 38.59% return for investors, whilst investors enjoyed 43.66% gain in local term.

The Lusaka Securities Exchange was however the best performing stock market in Africa, registering 93.2% gain in dollar and 52.21% in local term for investors.

On the other hand, the Malawi Stock Exchange was 3rd, with a return of 32.24% and 40.05% in dollar and local term respectively.

The GSE enjoyed one of its best runs in recent times last year, reversing three consecutive years’ losses.

During the first nine months of 2021, the Accra Bourse was actually the best performing stock market in Africa, until it was dislodged by the Lusaka Stock Exchange. This was due to the pressure on the local currency – the cedi.

Importantly, investor sentiments had sustained the growth of the market as the bond market also witnessed remarkable growth despite the existence of Covid-19.

At the end of December 31st last year, the market capitalization had grown significantly to close the year at ¢64.49 billion.

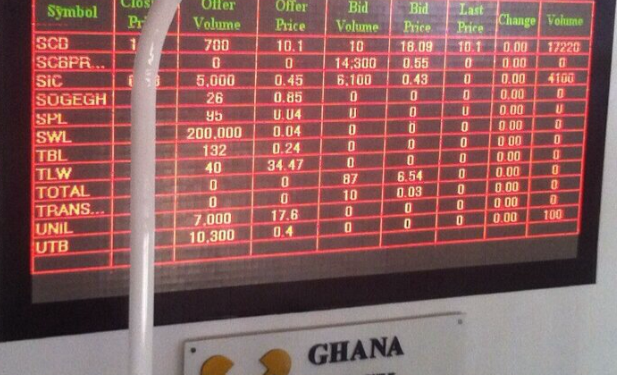

According to the trading results, 15 stocks on both the main and SME Market registered gains in their market value, whilst five stocks recorded losses.

The best performing stock was Fanmilk (+270.37%), followed by Guinness Ghana Breweries Limited (+100%) and Enterprise Group (+99.29%).

However, the worst performing stock was Cocoa Processing Company (-33.33%). It is still selling at 2 pesewas per share.

On the continent, the worst performing market was the Botswana Stock Exchange.

Below are rankings of best performing stock markets in Africa in 2021

| COUNTRY | STOCK EXCHANGE | RETURN |

| Zambia | LUSE ASI | 52.21% |

| Ghana | GSE-CI | 43.66% |

| Malawi | MASI | 40.05% |

| Coted’lviore | BVRM | 40.00% |

| Namibia | NSX 01 | 27.32% |

| South Africa | JSE ASI | 24.07% |

| Morocco | MASI | 19.55% |