With a rise of a tech-savvy generation, the Deputy Managing Director of the Ghana Stock Exchange (GSE), Abena Amoah, has assured investors of additional digital trading platforms that will allow easy access to the stock market by the end of this year.

In an interview with B&FT ahead of the Ghana Economic Forum (GEF), dubbed ‘Strengthening Homegrown Policies to Underpin the National Digitization Drive and Shared Financial Prosperity, Ms. Amoah said the Exchange has made sure to provide various platforms using technology such that the traders on the market can operate seamlessly.

“Already, we have seen some of the license dealers providing this service (digitized online trading tools), for instance, SC mobile from StanChart that allows investors and their clients to buy and sells orders on the Ghana Fixed Income Market (GFIM).”

We are partnering with the license dealing members and fintech companies to provide apps and digital online trading systems. We have launched one already and we are hoping that by the end of the year, we will launch additional two platforms on the market,” Ms. Amoah said.

Trading platforms such as IC Securities’ Tradelive platform is expected to attract an entire generation of active investors to build the right savings and investment culture that is much needed in the capital market industry to support its growth.

Currently, the Exchange is ensuring that all the traders on our market operate seamlessly through a clearing and settlement system.

“We have made sure to provide various platforms using technology for this to happen. This has been critical for us. That is why we have been awarded the most innovative stock market in Africa in 2008 and 2018,” Ms. Amoah noted.

“We are very much focused on making this to the next level where an investor who wants to buy a corporate or fixed-income instrument has access using digitization to trade on the market,” she emphasized.

GSE’s strategy is to collaborate with FinTech’s and Licensed Brokers to develop platforms for investors to trade electronically which would further support the development of the capital market.

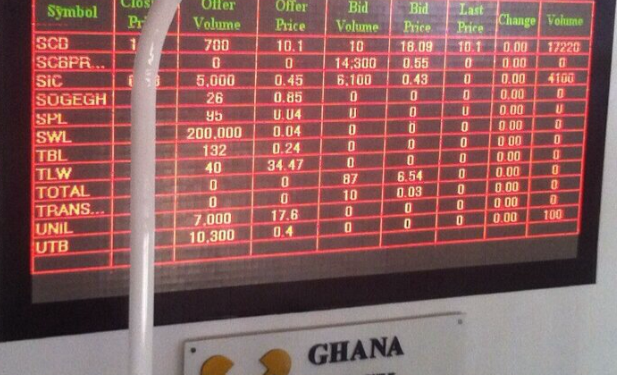

GSE Performance

The equities market’s cumulative performance from January to September 2021, in relation to the comparable period in 2020, shows that the volume of shares traded lessened by 0.82 percent from 403.92 million last year to 400.60 million in 2021. However, in value terms, there was an increase of 39.26 percent from about GH¢295.20 million to GH¢411.10 million; indicating a continuous rise in the value shares on the local equities market.

Accordingly, the year on year, market capitalization and the primary index, the GSE Composite Index (GSE-CI) are up 20.73 percent and 53.88 percent, respectively, with analysts anticipating further bullishness on the local bourse.