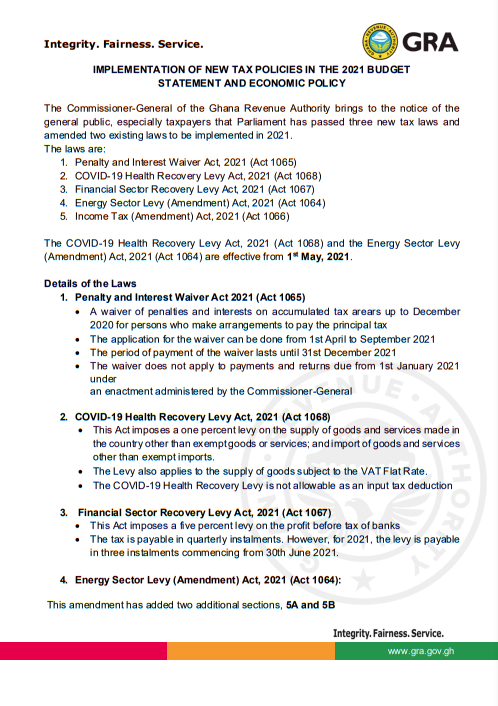

The implementation of the new tax policies announced in the 2021 budget statement and duly approved by Parliament will take effect from May 1, 2021.

The implementation date was announced in a statement issued by the Ghana Revenue Authority (GRA) on April 20, 2021.

According to the government the implementation of the new taxes which include the COVID-19 Health Recovery Levy, the Financial Sector Recovery Levy, the Energy Sector Recovery Levy and the Sanitation and Pollution Levy, is expected to help in rebuilding and strengthening the country’s public finances, deliver critical government services and support the transformation of the economy among others.

Parliament passed the laws to allow for their implementation at its last sitting on March 30, 2021.

Per the new notice from the Ghana Revenue Authority, the COVID-19 Health Recovery Levy will see the imposition of a one percent levy on the supply of goods and services made in the country other than exempt goods or services; and import of goods and services other than exempt imports.

The Levy also applies to the supply of goods subject to the VAT Flat Rate.

The Financial Sector Recovery Levy will lead to the imposition of a five percent levy on the profit before tax of banks. The tax is payable in quarterly instalments.

However, for 2021, the levy is payable in three instalments commencing from June 30, 2021.

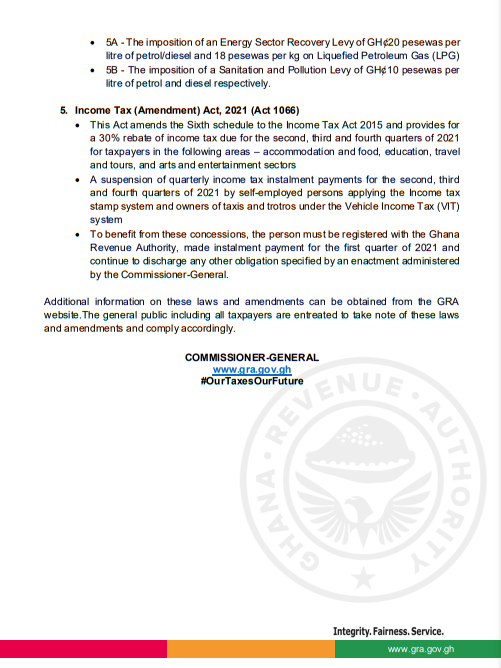

Meanwhile, the amended Energy Sector Levy will lead to the imposition of GH¢20 pesewas on every litre of petrol and diesel and 18 pesewas per kg on the price of Liquefied Petroleum Gas (LPG).

There will also be an imposition of a Sanitation and Pollution Levy of GH¢10 pesewas per litre of petrol and diesel respectively.

Read the full statement below: