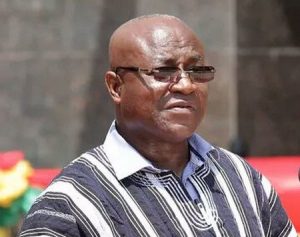

Member of Parliament for the Nhyiaeso constituency, Dr. Stephen Amoah has taken on critics of the government’s planned implementation of the much talked about Electronic Transfer Levy (E-levy) saying the move is not inimical to revenue generation for the country.

For him, E-levy though contested remains the most viable option available to the government in sustaining the economy.

“We have problems emanating from the time of Kwame Nkrumah, but since we took over, the improvements are there to show. I am not saying there is no cause for alarm, but let us discuss these issues out of deception and propaganda. Let us be honest and face the challenges and work on them because things are not that bad. COVID-19 really worsened situations, and it must be a lesson for us to begin a new paradigm shift for us to redefine our focus. We have to raise revenue and what is different if we use E-levy as a way of doing that”, the MP said on The Big Issue.

Touching on calls for Ghana to seek financial bailout at the International Monetary Funds (IMF) to restore fiscal stability other than the new tax policy, the MP said such suggestions are not meant to be in the interest of the country.

He made a point that the IMF’s interventions in the past have not been worthwhile in improving the receding economy, and therefore wants stakeholders to throw their weight behind the government to implement home-grown solutions to deal with the recurring economic woes.

“Our predecessors, that’s the NDC went to IMF but by the time they were losing the elections, we were growing at 3.2%, the interest rate was getting to 40% but did IMF help us? So how come after all the assistance from the IMF, the NDC had the worst defeat in the Fourth Republic? So should we rely on external support? For once, we should hold the bull by the horn and manage our own affairs. In the slightest shock, we are to rely on someone; how are we going to come out from challenges and troubles. We went to IMF, if it had helped us, why did the NDC lose the election when it came with conditionality that said we should not employ our own people for four years. Is this good for us? No, I don’t believe that, and we need the flexibility.”

Currently, the national conversation has been around the government pushing through the controversial 1.75% electronic transaction levy estimated to rake in some $1 billion annually or going onto an IMF program.

The tax measure was introduced by the government in the 2022 Budget on basic transactions related to digital payments and electronic platform transactions.

The rate in the budget was 1.75 percent, but it is expected to be reduced to 1.5 percent. Despite the intended reduction, there is still stiff opposition for its passage.

Some analysts have proposed seeking an IMF bailout as a better alternative amidst public disapproval of the E-levy, but the government has said it will have none of that.

Others have also brushed off calls for the government to go under an IMF programme, insisting that the options left for Ghana to consider are fiscal discipline, a reduction in wasteful expenditure, and the sealing of revenue leakages.