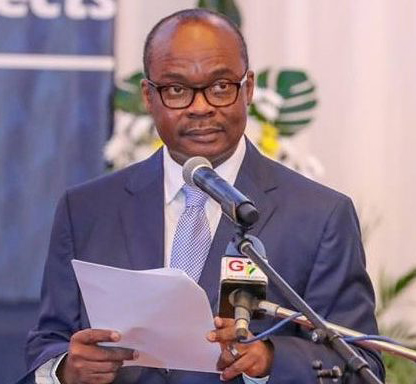

Governor of the Central Bank, Dr. Ernest Addison, has said that he is not sure when the Ghana Amalgamated Trust (GAT) cash, meant for helping five local banks meet the new GHC 400million minimum capital requirement, will hit the accounts of the five banks.

Asked by the B&FT when the banks should expect the GAT money to hit their accounts, Dr. Addison replied simply: “I cannot give you the exact timeliness on when the GAT money will hit their accounts. I think we should try to get that information from the GAT,” he told journalists in Accra on Monday.

The five banks could not meet the December 2018 deadline to increase their minimum capital from GHC 120million to the revised GHC 400million required minimum capital by the set deadline.

The five local banks namely: NIB, ADB, UMB, Prudential and OmniBSIC Bank were promised in December last year that through this special purpose vehicle—GAT—government will guarantee a GH¢2 billion bond to support them meet the new capital requirement.

The bond was supposed to be raised in March but as of now, nothing has been heard from government or the Bank of Ghana (BoG) regarding when it will be ready for disbursement to the specified banks.

This means the five indigenous banks are still operating below the GHC 400million its peers are using for their businesses.

MPC maintains policy rate

The Monetary Policy Committee of the central bank announced that the policy rate has been maintained at 16 percent, given recent developments that have led to a marginal increase in inflation.

Dr. Addison said: “On the inflation outlook, the Committee noted that the recent exchange rate pass-through has slowed the disinflation process, leading to a slightly elevated inflation profile as shown in the latest forecasts. However, core inflation remains subdued and inflation expectations fairly anchored.

Under the circumstances, the Committee decided to keep policy rate unchanged at 16 percent. The Committee will continue to closely monitor both global and domestic developments and stands ready to take appropriate measures, if necessary, to maintain price stability.”

The announcement came unsurprisingly as a 0.5 percentage point increase in inflation since January automatically ruled out any likelihood that the MPC will cut the monetary policy rate.

What this also means is that average lending rates of banks will continue to remain elevated as the policy rate determines to a large extent how much banks will lend to businesses and households. Average lending rates of banks currently hovers around 28 percent, a figure that businesses have constantly complained is too high and partly accounts for the high NPLs, about 18.9 percent, in banks’ books.

Source: thebftonline.com