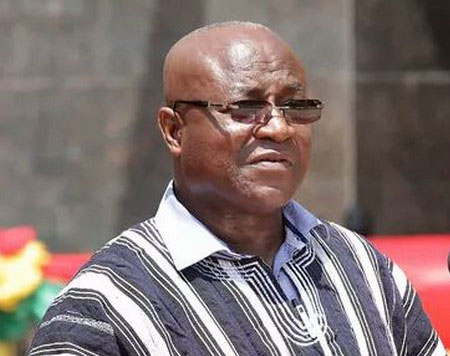

The Majority Leader, Osei Kyei Mensah-Bonsu, says the passage of the electronic transfer levy is in the best interest of the country and his side is happy to have championed it.

He said the delay in passing the bill over the past three months has taken a severe toll on the country’s economy including the withdrawal of foreign investments and a depreciation of the cedi.

“We have done what is good for the country. As a house we should position ourselves to monitor the proceeds,” he said at a press conference on Tuesday.

The Suame legislator added that, “the effect of this [long process] on the economy has not been good. Over the past three months, there was considerable uncertainty about our revenues, and Ghanaians, investors and Ghana Revenue Authority were worried, which explains why there was a lot of speculation in the system which led to the downgrading of our economy and a downward spiral of the cedi which raised the cost of living.”

Parliament on Tuesday passed the Electronic Transfer Levy in the absence of the Minority MPs, who had walked out before the Bill was considered at the second reading stage.

The Minority had complained that it had been taken by surprise by the unexpected consideration of the levy as it was not listed in Parliament’s business statement for this week

During a debate on the bill, the minority side lamented that the bill would worsen the plight of Ghanaians.

But the Majority Leader said he is convinced that the passage of the E-levy will bring huge relief to Ghanaians.

“To the extent that our colleagues were not rancorous, and no such infractions came, we should be thankful for them that we had a smooth conduct of business in the House, and we are moving the agenda of national development forward,” he said.

The levy, which was amended from 1.75 percent to 1.5 percent today, Tuesday, March 29, 2022, will be a tax on electronic transactions, which includes mobile-money payments.

The charge will apply to electronic transactions that are more than GH¢100 on a daily basis.

Critics of the proposal have warned that this new levy will negatively impact the Fintech space, as well as hurt low-income people and those outside the formal banking sector.

The levy has been the source of tension in Parliament since it was introduced in the 2022 budget.

The tensions culminated in a scuffle between lawmakers in Parliament in December 2021.

The government has, however, argued the levy would widen the tax net and that could raise an extra GH¢6.9 billion in 2022.

There are also concerns that the government may securitize proceeds from the e-levy to raise extra revenue.