Stakeholders within the financial sector are confident investors will continue to turn to the fixed income market, away from the equities market, until a time when the Coronavirus pandemic has been brought under control.

The poor performance of many companies on stock markets across the world and the uncertainty surrounding the quality of returns of such companies in the near future has seen many investors turning to bonds for guaranteed returns.

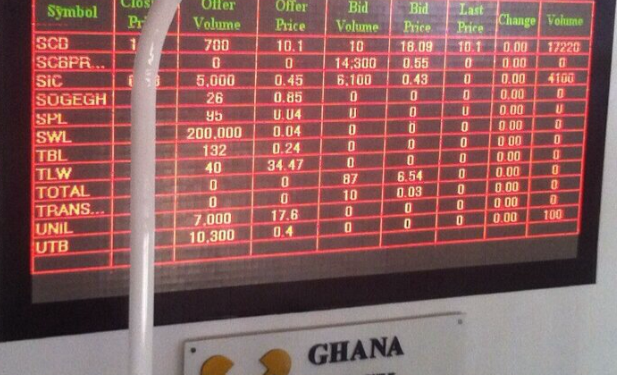

In Ghana, the Ghana’s Stock Exchange, which is primarily driven by financial and consumer stocks has also experienced yearly losses for the past three years, with the current year to date loss being about 18 percent.

This has led investors to move in droves from the equities market to the fixed income market.

Speaking to Citi Business News, on the shift in interest from stocks to bonds, the Deputy Managing Director of the Ghana Stock Exchange, Abena Amoah, attributed the losses on the equities market this year to the impact of the Coronavirus pandemic among others.

She however insisted the market was stabilizing and currently offers some opportunities for savvy investors.

“In terms of volumes traded and values traded, so far as to September, we have traded over GHS75 billion on the bond market. We are up by almost 34% of what we traded the entire last year and almost double what we did for the same period last year. The equities market, of course has seen some challenges. What we have noted is that volumes and values have risen compared to the same period last year, but there has been pressure on the selling prices. So, understandably with the coronavrus, a few foreign investors left the market.”

“This we saw was a trend all over the world. They left emerging and frontier markets and what that did was that savvy buyers in the market took the opportunity to hunt for deals. It was really a bias market and they demanded the prices that they wanted to see. And so that has depressed some of the share prices and that has made a lot of the valuations very cheap. And what we have seen in this last quarter of course is that savvy investors are back in the market looking for deals,” she said.

On his part, an Economist with DataBank, Courage Kingsley Martey, says despite the strong fundamentals of listed companies on the local bourse, he was certain investors will shy away from equities and invest in bonds until a vaccine for COVID-19 is found.

“However, we also know that investors at the moment are so apprehensive that they do not want to rely only on the fundamentals. And this is where there will be a setback or a drawback as far as a potential recovery or the strength of the market recovery will be in 2021. So whiles I want to be cautiously optimistic and keep my fingers crossed that once COVID-19 starts to fade away, and there is a vaccine, then we should start to see some improvement in investor confidence.”

“We should start to see risk coming back across the global economy and that should help revive foreign portfolio flow back to our market and help boost the recovery of our market,” he said.

The novel Coronavirus pandemic, as at October 29, 2020, had claimed almost 1.2 million lives and infected over 45 million people globally.

It has devastated economies and businesses, aside from revealing weaknesses in global health systems and supply chains, especially in Africa.