The Bank of Ghana says it will support the government’s budget with 10 billion cedis to enable it address the economic impact of COVID-19 on the country.

This will include an initial amount of 5.5 billion cedis of the COVID-19 relief bond.

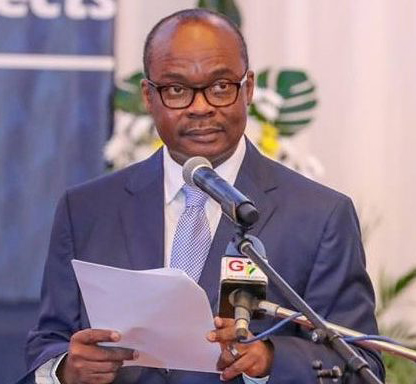

The Governor of the central bank, Dr. Ernest Addison, disclosed this at a meeting with journalists where he announced the policy rate on Friday [May 15, 2020].

By this decision, the Bank of Ghana has set aside a Memorandum of Understanding with the IMF which bars it from financing the government’s budget which had been the case in previous years.

“Under the circumstances and in line with section 30 of the Bank of Ghana Act (2002) Act 612 as amended, the Bank of Ghana has triggered the emergency financing provisions which permits the bank to increase the limit of Bank of Ghana’s purchases of government securities in the event of any emergencies to help finance the residual financing gap,” Dr. Addison remarked.

He added that “Today, under the Bank of Ghana’s asset purchase programme, the Bank of Ghana has purchased the government’s COVID-19 relief bond with a face value of 5.5 billion cedis at the monetary policy rate with ten year tenure and a moratorium of two years; principal and interest.”

The Governor further indicated that they will provide an additional 4.5 billion cedis through the purchase of government assets, but that will be dependent on developments going forward.

“The bank stands ready to continue with its assets purchase programme up to ten billion cedis in line with the current estimates of the financing gap from the COVID-19 pandemic,” he added.

Since 2016, the Bank of Ghana has stopped financing the government’s budget which had been viewed as a condition for the overrunning of budgets in successive years.

As part of measures to control budget overruns, government has passed the Fiscal Responsibility Act.

The law, among others, sets a cap of 5% for Ghana’s budget deficit – which is the difference between the revenue and expenditure for any given year.

Per the sanctions outlined in the law, any Finance Minister who flouts this directive is likely to face prosecution which could culminate in a jail sentence.

Already, the Resident Representative of the IMF to Ghana, Dr. Albert Touna Mama, has advised African governments to focus on investments in health in the interim, and shelve discussions on possible escalations of budget deficits due to the default in loan repayments.

Source: Citibusinessnews.com