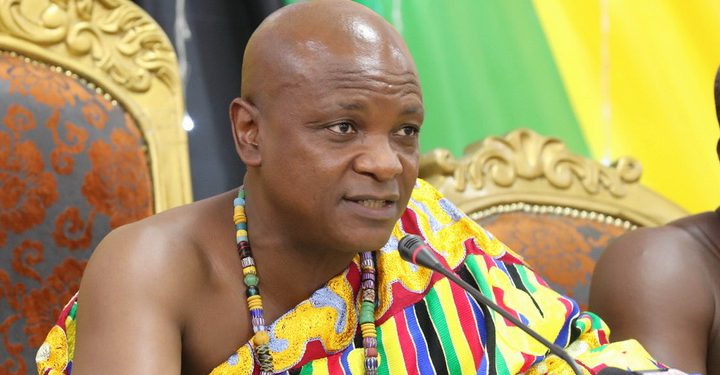

Ghanaian Entrepreneur and President of the National House of Chiefs, Togbe Afede XIV, says the banking sector clean-up could have been handled better by government.

According to him, the Securities and Exchange Commission (SEC), could have carried out a better scrutiny to prevent the collapse of the huge number of financial institutions that lost their licenses.

Togbe Afede, who once served on the Bank of Ghana Board for a decade, lamented the poor management of the clean-up process by the Central Bank.

“I’ve said it before that the process was not managed well. If you have crossed indebtedness among several institutions, you want to open their books and see where you can do set-offs in the first place. Otherwise, if I owe you GHS10.00, you also owe someone GHS9.00, who also owes someone GHS8.00, if I fail to pay you, you are in trouble. If you fail to pay the other party, he is in trouble. So if suddenly, all of us are collapsed, we all are gone.”

He continued, “On the other hand, if we examine all our books, it will be realized that if Togbe pays you the GHS10.00, everybody else is covered; then through set-offs, Togbe becomes the only person who goes, not all of us. I think there were a lot of mistakes in the way it was was handled. So by the time probably they realized, it was too late to do it differently; so they saw many companies that collapsed.”

The clean-up

As part of its efforts to restore confidence in the banking and specialized deposit-taking sectors, the Bank of Ghana (BoG) embarked on a clean-up exercise in August 2017 to deal with insolvent financial institutions whose continued existence posed risks to the interest of depositors.

The clean-up saw the revocation of licenses of nine universal banks, 347 microfinance companies, 39 microcredit companies or money lenders, 15 savings and loans companies, eight finance house companies, and two non-bank financial institutions.

The move by the central bank was a comprehensive assessment of the savings and loans and finance house sub-sectors carried out by the BoG in the last few years after it identified serious breaches.

The Securities and Exchange Commission (SEC) in November 2019 also revoked the licenses of 53 Fund Management Companies following the companies’ failure to “return client funds which remain locked up and in a number of cases, have even folded up their operations.”

The action was taken pursuant to Section 122 (2) (b) of the Securities Industry Act, 2019 (Act 929) which authorizes SEC to revoke the license of a market operator under some circumstances.

Source: Citibusinessnews.com