The Monetary Policy Committee (MPC) of the Bank of Ghana has maintained the policy rate at 14.5 percent after a similar decision in July 2020.

The policy rate determines the rate at which the central bank lends to commercial banks.

It also determines how much interest people pay on their loans.

The MPC, after concluding its meeting on Monday 28th September 2020 said the decision has been influenced by uncertainties in the economy caused largely by the COVID-19 pandemic.

In March 2020, the MPC reduced the rate by 150 basis points from 16 percent to 14.5 percent, and the figure was maintained in May as well as in July 2020.

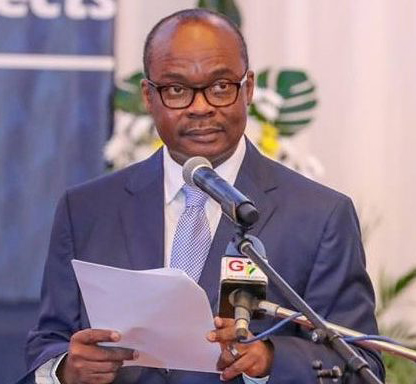

Speaking at the 96th MPC Press Conference, Dr. Ernest Addison said maintaining the policy rate was necessary to ensure stability in the inflation rate and economic growth.

“With the easing of the COVID-19 restrictions, related food price pressures and continuous stability in the exchange rate, the gradual and steady return of inflation to target is anticipated throughout. Underlying inflation and expectations are easing. The latest forecast shows an improved outlook compared to the last MPC and in the absence of unanticipated shock, inflation should return to the medium-term target by the second quarter of 2021. The drivers of economic growth are returning to normalcy with prospects for a quick recovery.

Monetary and fiscal policies have been supportive, providing the necessary underpinnings for the economy to withstand the negative shock arising from the pandemic. However, this has come at a cost of moving away from the consolidation fund and propose a risk to long term macroeconomic stability in decisive measures are not taken to defy the feasible fiscal adjustment to stabilize debt. Under the circumstances, the Committee’s view is that the immediate outlook for inflation and growth are well-balanced and decided to keep the policy rate unchanged at 14.5 percent,” he said.

Source: Citibusinessnews.com