The Monetary Policy Committee (MPC) of the Bank of Ghana has reduced its key lending rate to commercial banks in the country. The Committee reduced the policy rate by 100 basis points to 16 per cent.

This is the first time since March 2018 that the Bank of Ghana has reduced its policy rate for universal banks. In March 2018, the Bank of Ghana reduced its rate by 200 basis points from 20 per cent to 18 per cent. The development is likely to influence the cost of credit in the country.

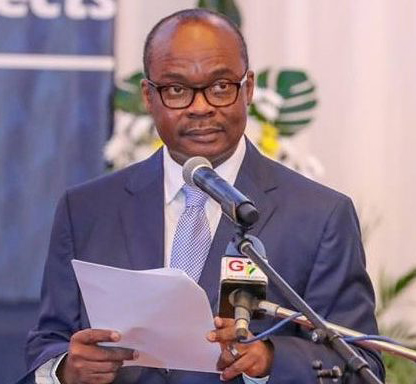

According to the Central Bank, the move was influenced by a fairly stable outlook for the economy. Speaking at a news conference after meeting to review the health of the economy, Bank of Ghana Governor, Dr Ernest Addison said they are also convinced about measures government is taking to stabilize the economy and check its rising expenditure.

Recapitalization

The recapitalization exercise ended in December 2018 with a total of 23 banks meeting the minimum requirement.

These banks are sound, liquid and well-capitalized, and well-positioned to translate the gains made so far from two years of far-reaching reforms to the rest of the economy. At the end of December 2018, total assets of the banking sector grew by 14.7 percent year-on-year to GH¢107.3 billion.

“Growth in industry assets is expected to rebound as banks deploy their newly-injected capital towards financial intermediation,” BoG said in a statement.

Clean up

According to BoG, the clean-up exercise has also protected deposits of over 1.5 million depositors with deposits of GH¢11.6 billion. This includes deposits of savings and loans companies, rural and community banks, investment fund managers, pension funds, and life insurance companies with the banks.

“Looking ahead, there will be a need to focus on reducing the high NPLs in the sector and addressing the risks associated with the high degree of interconnectedness in the financial system which will require close monitoring to ensure financial stability,” the statement said.

Below is the full statement from the Bank of Ghana

BoG Monetary Policy Press Release – January 2019Source: Joy Business