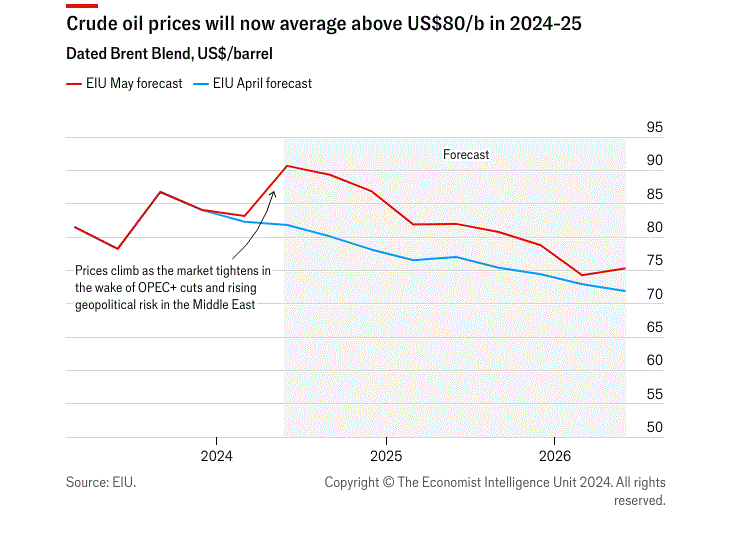

The Economist Intelligence Unit is forecasting that oil prices will remain above $80 per barrel until late 2025.

This, it said, will lift inflationary pressures in many countries at a time when their currencies are losing ground against the dollar.

Based on recent data from the International Energy Agency, the global oil market fell into deficit (with demand outstripping production) in the first quarter of 2024. Due to this evolving supply-demand dynamic and rising geopolitical pressures, we revised up our oil price forecasts, with dated Brent Blend to remain above US$80/barrel until late 2025. This will lift inflationary pressures in many countries at a time when their currencies are losing ground against the dollar.

EIU also projected that oil prices will continue to trade at nearly $90 per barrel for at least the next few months. Besides the market deficit, higher prices will also be supported by rising tensions in the Middle East as the Israel-Hamas war threatens to widen into a broader regional conflict.

“Even if disruption to oil shipments from the region remains minimal and traders shrug off concerns about military escalation, prices are set to remain high as the global market remains in deficit until late in the year [2024]. We expect that OPEC+ will strictly observe reduced output quotas and that Saudi Arabia will continue to adhere to additional, sharp voluntary cuts until at least mid-2024 and only slowly lift production towards the end of 2024 at the earliest”, it pointed out.

The EIU added that “We continue to expect US production to increase moderately in 2024 before stabilising in 2025, but the recent rise in prices is not enough to elicit a stronger supply response. The US oil rig count, at 508, is actually down by 14% from a year ago, according to Baker Hughes, an oilfield services firm, as US oil companies continue to prioritise dividends for shareholders”.

It still forecasted that global oil demand will hit record highs in 2024 and 2025, adding, demand in developed economies will decline, although North America will remain an exception to this trend.