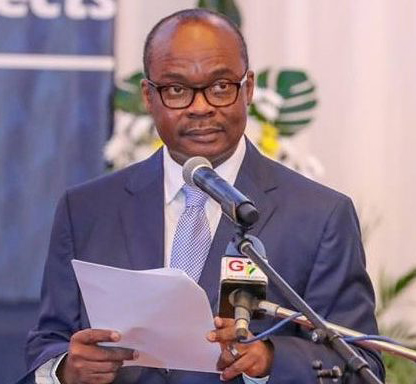

The Governor of the Bank of Ghana, Dr. Ernest Addison, has said that the economic outlook of the country for 2022 is positive although there are some potential risks which should be closely monitored.

“In particular, the uncertainties surrounding food prices, petroleum price adjustments, and the potential second round effects of these are likely to exert inflationary pressures in the outlook”, he disclosed this at the 2021 Chartered Institute of Bankers Annual Dinner Event.

“The recent widening of the Ghana’s sovereign bond spreads after a successful bond issue in April 2021 surprised all of us, although we were aware of investor sentiments and their assessment of Ghana’s fiscal risks as they see the fiscal deficit outturn for 2020 as unsustainable and expecting very bold and decisive measures from the government to re-anchor fiscal consolidation and stabilize debt”, he pointed out.

Continuing, Dr. Addison said “the Investors have assessed that, as compared to our peers, Ghana required a stronger fiscal rectitude to re-establish investor confidence, and did not see the mid-year budget as addressing their sentiments. The markets assessment of the 2022 budget also suggest lingering doubts about the ability of the revenue measures announced to translate into a large increase in domestic revenue. To add to this, government expenditure is projected to increase significantly in 2022.”

He noted that the widening spread triggered investor sell-offs and has created a huge financing gap and subsequently put pressure on the local currency, adding, “as a Market Access Country, we have a huge burden to demonstrate a strong recovery and to ensure that the bold revenue measures introduced yield the required results.”

“We are at a point where there is no room for policy forbearance on all levels, otherwise the huge financing burden could unravel the anchor and erode the gains we have made in the last 4 years. This calls for a social contract on fronts with common aspirations across the aisle to make sure we sustained the recovery momentum”, the Governor intimated.

Banking sector outlook positive

The Governor also said broadly, the banking sector outlook remains positive.

This he said is because results from the November 2021 stress tests show a banking sector that remains resilient to mild and moderate credit risk and liquidity stress conditions.

“The potential effects of a prolonged pandemic on the banking sector, particularly on asset quality, however, needs to be monitored carefully to inform policy measures. The Monetary Policy Committee decided that macroprudential policy measures and regulatory reliefs announced at the onset of the pandemic should remain in place to support a more robust recovery of the economy”, Dr. Addison said.

Digital financial services growing rapidly

Currently, there are more than 19 million active mobile money accounts driving the digital financial services industry. Prior to the pandemic, this number was 14.4 million.

Similarly, mobile money interoperability continued to show strong growth of about 365% in transaction volumes and 651% in transaction values between 2019 and 2020. These trends, the Governor said point to increased consumer confidence and preference for digital payment options in the economy. “Collectively, therefore, we, as stakeholders, must leverage on these positive headwinds to develop and implement digital strategies to spur growth in the digital financial services sector”.

He reiterated that efficient, convenient, and safe digital financial services are central to the digital economy and for ensuring a financially inclusive society.

Furthermore, he stated a sustainable digital banking environment should be people centred, therefore banks’ resources and efforts should be guided by inclusive strategies that promote the integrity of the payments ecosystem to build confidence in users.

“These initiatives, in addition to lessons provided by Covid-19 pandemic, should provide the needed stimulus for developing a robust, resilient and inclusive digital financial service industry supportive of a digitized Ghanaian economy”, he added.