After recording negative returns for three successive years from 2018 to 2020 – the longest and deepest bear market in its three decade history – a bull market has returned to the Ghana Stock Exchange with the stock market’s composite index rising by about 36 percent during the first half of 2020 in cedi terms. The composite index tracks the weighted average change in the share prices of the 36 companies currently listed on it.

During the first half of 2020 the stock market delivered negative returns of some 16 percent although last year’s fall was in line with most other competing emerging market bourses as the spread of COVID 19 took its toll on equity prices all around the world.

Indeed, the GSE’s recovery has been attributed in part to the discovery and deployment of multiple vaccines which immunize people against the global pandemic, allowing for a gradual return to normalcy in societies and economies all around the world.

However, the primary reasons for the long awaited return of a bull market to the GSE are economic. One is that share prices have fallen so low that price earnings ratios are at a long term low with some blue chip stocks actually trading of a p/e ratio of one, meaning that investors could recover their share purchase investment from just one year’s dividend payout. Another is that the exchange rate stability of the cedi against the US dollar means foreign investors have not been incurring foreign exchange losses in recent times, which is encouraging them to increase their equity holdings, or at least not sell what they are already holding. Indeed, the outstanding 36 percent return delivered by the GSE for the first half of 2021 translates to virtually the same return in dollar terms which makes Ghana’s bourse one of the best performing in the world so far this year.

Thirdly, interest rates are falling on fixed income securities making returns from equities more competitive. It is instructive that the dominance of the most recent bear market for listed equities has coincided with significantly increased trading and liquidity in the GSE’s Fixed Income Market, GFIM. In late May the Bank of Ghana took most financial economists by surprise when it cut the benchmark Monetary Policy Rate by 100 basis points to 13.5 percent. This has come on the back of continuous falls in short term interest rates over the past year since the central bank cut the MPR by 150 basis points in March last year as it began monetary easing in an effort to avert an economic slump from arising due to the arrival of COVID 19 in Ghana. While medium to long term interest rates have fallen more slowly in order to retain the interest of foreign investors, who are allowed to subscribe to government securities with tenors of two years and above, they have also been falling since the last quarter of last year.

This has created a risk premium for equities which has encouraged investors to move from fixed income securities to equities.

The Ghana Stock Exchange Composite index (GSE-CI) which reflects the average performance of shares of all listed companies on the local bourse has recorded mixed returns, in the past decade.

Recorded returns for investors in the last 3 years, however, have all been negative.

According to data from the local bourse, returns in 2018, 2019 and 2020 were -0.29 %, -12.25 % and -13.98 % respectively.

Renewed confidence in the equities market buy local investors, particularly institutional investors has however seen increased demand for stocks pushing their prices upwards again especially as investors now correctly reckon that the market has troughed and there is lots of upward price gains potential to be exploited.

The General Manager of UMB Stockbrokers identifies several reasons for the turnaround at the GSE:

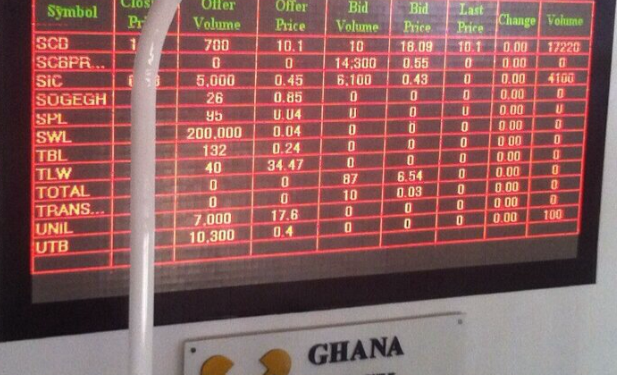

“I think what has generally driven the market is the performance of some stocks on the market. Generally, the market has performed well, but if you look at the stocks of Enterprise Group, GCB, SG-SSB, MTN, they have all done quite well. But MTN, in particular, has done almost about 80% return for the market from the beginning of the year till now, and that kind of return has driven a lot of investors to that stock and the GSE in general.”

“Compared with last year, we have so far done 25% more in terms of volumes traded on the market. In terms of values of transactions traded, we have done almost 60%. When you look at all of these things, there is a certain confidence that has come in respect of the market. Also, you will notice that the returns on government of Ghana securities have been trending downwards and investors are now open to alternatives like the equities market,” he adds.

The capitalization of the GSE has consequently improved significantly in the first half of 2021 when compared to the same period of last year. It started 2021 valued at GHc54.4 billion and ended June valued at GHc61.3 billion, representing growth of 12.7 percent.

Actually the growth would have been higher if not for the de-listings which have dogged the stock market in recent times. Over the past year both PZ Cussons and Mechanical Lloyd have voluntarily delisted from the bourse as they seek to inject new equity finance which minority shareholders do not want to contribute to because of the negative returns they have been suffering on their investments over the past few years.

Some of the biggest gainers over the period under review were MTN, Guinness Ghana Breweries Limited and GCB Bank with their stocks appreciating by about 88 percent, 43 percent and 33 percent respectively.

MTN started the year trading at 64 pesewas but ended June trading at GHc1.20; Guinness Ghana Breweries Limited began at 60 pesewas and ended June trading at GHc1.29; GCB Bank on the other hand started 2020 trading at GHc4.05 and ended June trading at GHc5.40.

The herd instinct can now be expected to kick in driving share prices up even faster as investors seek to get on board the rising market before it pelters out.