The Member of Parliament (MP) for Bawku Central, Mahama Ayariga, says he is confident Prince Kofi Amoabeng and Dr. Kwabena Duffuor, will submit all documents that back their request for the restoration of the licences of their respective financial institutions, before the end of the one-week window.

The parliamentary committee tasked to probe the collapse of uniBank and UT Bank on Tuesday, April 27, 2021, directed the petitioners to make their evidence and documents available within a week.

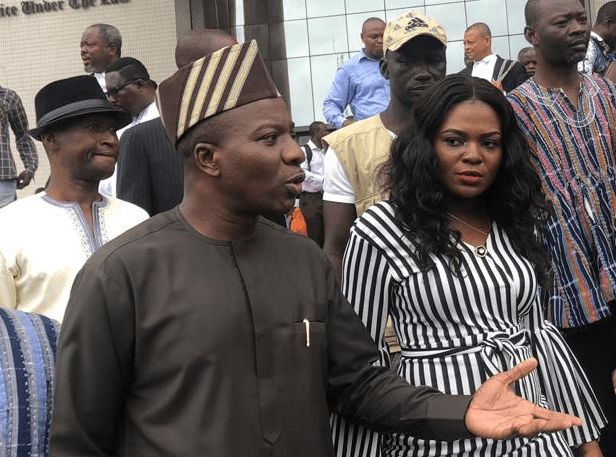

Reacting to the directive on Eyewitness News, the Bawku Central MP said he will ensure that the required documents get to the committee in time.

“The petitions that were presented mostly set out the claims based on which the petitioners were petitioning Parliament. The petitioners themselves will usually not have all the relevant documents attached to it,” he said.

“Now that the committee will want to consider the petition, I am sure the petitioners are in a position to provide whatever information is within their domain. The petitioners are in the process of submitting the documents before the given week. The letter is addressed to me, and I will make sure I get them to the committee before the one-week deadline and then await further directions from them. The committee will then decide what steps to take next.”

The proposal for the formation of a seven-member committee to probe the issues came after the petitions were officially presented on the floor by Mr. Ayariga on Tuesday, March 23, 2021.

When asked about his motivation for championing the cause, Mr. Ayariga said it is his desire to ensure that justice is served.

“Every citizen who thinks or feels they have been treated unfairly has the right to seek redress. Our constitution is founded on freedom and justice and any Member of Parliament must be ready to assist any citizen who feels unfairly treated by any institution of the state,” Mr. Ayariga added.

Background

The two businessmen, Prince Kofi Amoabeng and Dr. Kwabena Duffuor petitioned Parliament to investigate the conduct of the central bank and the Ghana Stock Exchange following the revocation of the licences of their respective financial institutions.

Dr. Duffuor, founder of the now-defunct uniBank, and Mr. Amoabeng, former Chief Executive Officer of the collapsed UT bank, had the licenses of their respective financial institutions revoked during the banking sector clean-up which commenced in 2017.

For UT Bank, the apex bank claimed it took the action against the institution because it was insolvent and was unable to recapitalize despite several assurances from the company’s shareholders.

The apex bank also gave similar reasons for the revocation of uniBank’s license, saying the financial institution was significantly undercapitalized.

The Bank of Ghana also claimed that shareholders of uniBank used monies from the bank to acquire estate properties in their own names.

According to the central bank, “uniBank’s shareholders and related parties admitted to acquiring real estate properties in their own names using the funds from the bank under questionable circumstances.”

While uniBank was merged with four other banks to form the Consolidated Bank Ghana Limited, the Bank of Ghana gave GCB permission to takeover UT bank.

Dr. Duffuor is currently litigating the collapse of his bank with the hope of getting the court to declare that, merging his bank with others to form the Consolidated Bank is null and void.

Mr. Amoabeng, per the petition documents, said his bank’s licence was revoked “without due regard to the rules of Administrative Justice guaranteed under article 23 of the 1992 Constitution.”

He is thus asking Parliament to give a directive for the restoration of the licence.