The Registrar General and Liquidator for the collapsed Fund Management Companies (FMC) has begun official processes to liquidate 20 out of 53 firms whose licenses were revoked by the Securities and Exchange Commission (SEC) in November 2019.

It follows a High Court order for the formal winding up of the companies.

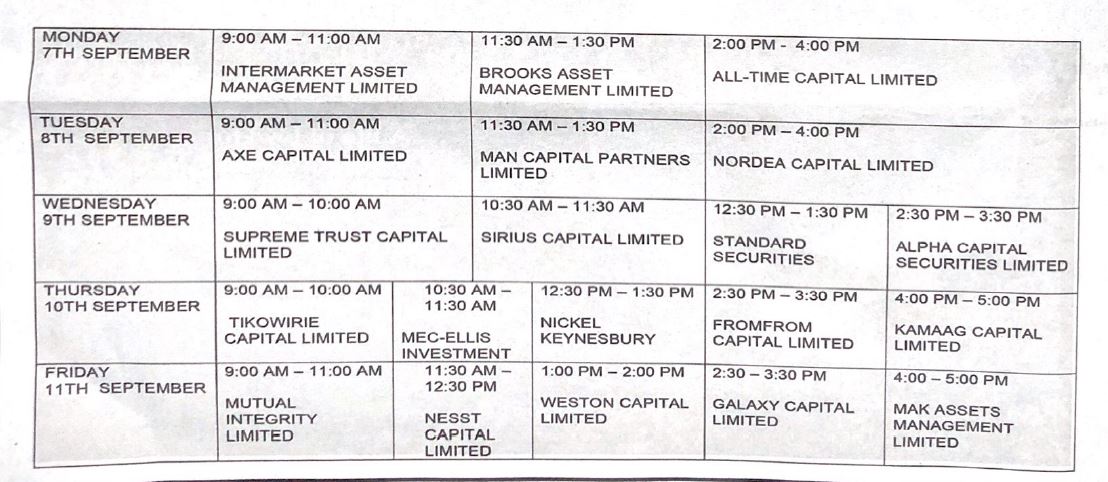

To this end, creditors of 20 of the affected companies are being invited to the first virtual creditors meeting scheduled for Monday, September 7 to Friday, September 11, 2020, to have their claims validated for payment.

Links to the meeting shall be delivered to all creditors via text.

Those who have not received text messages are being encouraged to call 0244369143 to have their contact details rectified to receive an invitation to the meeting.

Two other FMCs, QFS Securities Limited and Ultimate Trust Limited, are yet to have their liquidation orders gazetted for further action to bring the total number of companies to be liquidated to 22.

The Official Liquidator, Jemima Oware in an interview on the Citi Breakfast Show disclosed that, “We petitioned the Judicial Service and luckily, they gave us one single court and an Appeals Court Judge to consider all the 53 petitions and that is what helped us. That is how we came far to get 22 winding orders. But why we are dealing with 20 is because with the process of liquidation, you have to gazette the orders when you receive them. So for now, I have been able to receive 20 from the court that have been drawn up and signed. So that is what we are going to start with.”

List of 22 FMCs set to be liquidated:

1. Alpha Cap Securities Limited

2. Alltime Capital Limited

3. Axe Capital Limited

4. Brooks Asset Management Limited

5. CDH Asset Management Limited (Intermarket)

6. Fromfrom Capital Limited

7. Galaxy Capital Limited

8. Lifeline Asset Management Limited (Kamaag)

9. Mak Asset Management Limited

10. Man Capital Limited

11. Mec-Ellis Investment (Ghana) Limited

12. Mutual Integrity Limited

13. Nesst Capital Limited

14. Nickel Keynesbury Limited

15. Nordea Capital Limited

16. Sirius Capital Limited

17. Standard Securities Limited

18. Supreme Trust Capital Limited

19. Tikowrie Capital Limited

20. Weston Capital Management Limited

Payment

Meanwhile, the liquidator has assured that payment to the customers in the first phase will commence before the end of September 2020.

“Before the end of September, we should start paying the first set of 20 investment claims to be validated. There are processes I will spell out to them at the creditor meeting. I am not going to pay monies for payment’s sake. There is a process and as an official liquidator, I have to get an asset to payout.”

SEC, acting in accordance with Section 122 (2) (b) of the Securities Industry Act 2016, (Act 929) (SIA) revoked the licenses of 53 FMCs on 8th November 2019 due to their inability to return clients’ funds to the tune of GHS8 billion.

The companies also engaged in other forms of financial irregularities that affected their stability.

SEC’s action was part of processes to clean up the country’s financial sector.

Below is the schedule of virtual creditors’ meeting

Source: Citibusinessnews.com