Importers are convinced that the country will suffer a revenue shortfall this year but fear that the government will turn to the usual victim — new taxes — in an attempt to narrow the gap.

At a time when the raging novel Coronavirus disease (COVID-19) had weakened demand continuously threatening the survival of businesses, the trading community said any attempt to use new or additional taxes to boost revenue would be a nightmare to businesses.

They have, therefore, called on the government to use the mid-year budget review due later this month to announce a comprehensive policy that will meaningfully expand the tax net to help increase revenue collection

Shortfall

The call comes in the wake of a decline in government’s revenue and grants by GHȼ3.59 billion as against a target of GHȼ13.95 billion for the first quarter of 2020.

An analysis of the first quarter provisional fiscal data on public finances showed that the government missed all the revenue target for the period under review.

While a total of GHȼ10.35 billion was collected for the period under review, the novel coronavirus broke out in the country in March 12, and so therefore, the second quarter data will rather provide a clearer picture on the impact of the pandemic on the government’s revenue collection.

Consequently, the government is seeking to rake in some GHȼ67.07 billion in taxes and grant by the end of this year.

Instead of bringing new taxes to bridge the differences in revenue collection, the importers said the government should rather focus on reviewing the whole tax structure to create what they described as an appropriate environment that will bring all business activities into the tax bracket, rather than exempting some.

Expanding the tax net, they said, should include scaling-up of the tax stamp initiative, encouraging the issuance of value added tax (VAT), improving tax education, passage of the exemption bill and blocking all the loopholes in the country’s tax administration.

Innovation

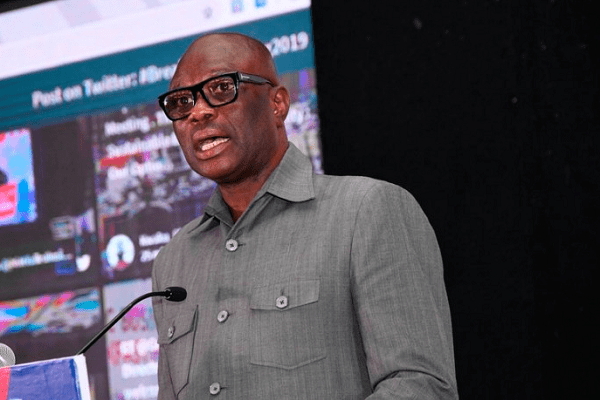

In an interview with the GRAPHIC BUSINESS on July 10 in Accra, the President of the Ghana Union of Traders Association (GUTA), Dr Joseph Obeng, observed that the government must be very innovative and bold in broadening the tax net in order to rake in enough revenue to support development projects.

Given the impact of the pandemic on other economies, he said there was the need for a review of the whole tax structure to create the appropriate environment that would encourage tax compliance and inclusiveness.

According to him, for a long time the country had paid lip-service to widening the tax net, while low hanging areas such as revenue from e-commerce business, property tax and attracting private capital into infrastructural development were left untapped.

“We have been speaking about tax expansion but had fallen on deaf ears and the few people paying the taxes have been the same people who are always overburdened.”

“As businesses, we are not expecting new taxes in the mid-year budget and so, we believe that this is the right time for the government to introduce strong measures to expand the country’s tax net.

“Although the second quarter data has not been made public yet, there was the need for the citizens to support the government, as revenue was likely to fall short under the current circumstances,” he said.

Tax structure

In reviewing the tax structure, the President said the country should focus on scaling-up of the tax stamp initiative, encouraging the issuance of value added tax (VAT), improving tax education, passage of the exemption bill and block all the loopholes in the country’s tax administration.

“An improved tax stamp policy was a key initiative to capture the informer sector.

“The threshold on VAT must be removed. VAT payment should be compulsory in order to ensure that all citizens are captured into the tax net. This will encourage voluntary compliance.”

“The current tax structure does not ensure parity and encourage people to pay their taxes,” he said.

With free education and other social interventions implemented, Dr Obeng stated that the government must take steps to enforce voluntary tax compliance by the citizenry.

Exemptions

For his part, the Co-Chairman of the Abossey Okai Spare Parts Dealers Association, Mr Clement Boateng, corroborated the views of the GUTA President, saying the government must take the needed steps to restructure the tax system to improve collection from areas that have been neglected for long.

He asked for the immediate passage of the Tax Exemptions Bill, which seeks to lay out a clear criteria for giving tax holidays to businesses, to help streamline and address the shortfalls in revenue mobilisation.

While the country missed all its revenue target, he said data available indicated that about GHȼ43.08 million was lost to tax exemptions.

Mr Boateng observed that the country’s tax system was unduly complicated and needed to be simplified to encourage compliance.

He said a section of the public was not tax compliant because of the complicated nature of calculating tax under the current system.

The Co-Chairman added that the government must also use the mid-year budget to review the extension of the two per cent special import levy.

Source: Graphic.com.gh